An In-Depth Look At What’s Really Happening Among Small Businesses. Alignable, the largest online referral network for small businesses, is releasing two new reports today, giving an in-depth look at what’s really happening among small businesses right now as they struggle with a sluggish recovery. The reports are based on a survey that just concluded on Sunday, 10/24/21 among 3,181 small business owners, as well as data from 650,000 other SMB owners collected since March 2020.

1. Alignable’s October Road To Recovery Report. Here are just a few highlights:Only 30% of small businesses report that they’re fully recovered. (Up 2% from last month, but still down 5% from its July peak).

The estimated date for a full recovery for most SMBs has been pushed out yet another quarter, landing sometime in 2023. (In July, the date was mid-2022, 9 months earlier).

Inflation is now seen as the biggest hurdle to a full recovery: 48% say it’s their chief concern now. (That’s up 10% from Sept., when Delta-related government re-closures ranked as the top worry).

85% of small businesses say they’re suffering from the increased cost of supplies and inventory, but only 50% feel able to pass those costs onto consumers.

Alignable’s October Hiring Report is also out today and the findings show increased frustrations among small business owners across many sectors.

For the second month in a row, 2 out of 3 (65%) of small business owners say they’re having trouble hiring staffers.

But when they actually find people to hire, 64% of small business employers must pay higher salaries than they did prior to COVID. That’s a 9% increase over last month, when only 55% reported paying higher wages to attract and retain employees.

Restaurants, as well as transportation and construction companies. top the list of those struggling with the labor shortage and wage hikes. Read more here at https://www.alignable.com/forum/alignable-road-to-recovery-report-october-2021?utm_campaign=October&utm_medium=Press&utm_source=Press

For six months now, many industries have experienced a devastating labor shortage and, in fact, it remains a major factor for nearly 2 out of 3 small businesses in October.

On top of that, 9% more small business owners report needing to pay higher wages for the employees they can actually find. That figure is now 64% (up from 55% just last month).

Add in the increased percentage of small businesses reporting that supplies are more expensive than they were before COVID (60% in October vs. 57% in September), and you have a recipe for a truly sluggish recovery moving into November.

Further exacerbating the problem, for the second month in a row, 85% of small businesses say they’re having significant trouble accessing the supplies they need — and paying more for what they can source.

Less Than 1/3 Have Recovered Fully (At Least For Now)

All of this adds up to only 30% of small businesses reporting that they’ve fully recovered, earning as much if not more monthly revenue than they generated prior to COVID. While that’s 2% higher than September, it’s still 5% lower than its July peak of 35%.

These new findings are part of Alignable’s October Hiring Poll of 3,181 small business owners surveyed from 10/8/21 to 10/24/21.

While 65% of small businesses tell us they’re struggling to find the right employees, many of the industries most affected are dependent upon those employees to drive revenue for the companies.

But if they don’t have sufficient staffing, they lose revenue they otherwise could generate for their recovery — and, in fact, their survival in some cases.

Transportation, Restaurants & Construction

The most-affected small businesses in October include 82% of the transportation company owners surveyed, such as Uber, Lyft, or taxi businesses.

A similar situation exists for 78% of restaurant owners, who say the lack of staffers cuts into the number of customers they can serve, as well as their hours of operation, which have been reduced significantly by many restaurants suffering from staffing snafus.

Some also report that customers are getting tired of the long wait times and aren’t coming back as often as they would when restaurants are fully staffed and operating normally.

This chart summarizes highlights of October’s findings:

More than 7 out of 10 owners (71%) of small construction companies, as well as general contractors, say they can’t find the help they need, or if they do, the wages they must pay cut into their already dwindling profits.

Others facing month after month of labor shortages taking their toll on business recoveries include:

- 68% of all travel agents and hotel/bed and breakfast owners

- 67% of small business people running auto repair shops or dealerships

- 61% of all retailers, which is especially alarming considering that we’re coming up on a time when many shops usually need extra help to handle holiday shoppers. This figure is identical to September’s number, but it could go up in November.

Majority Pay More For Help When They Do Find It

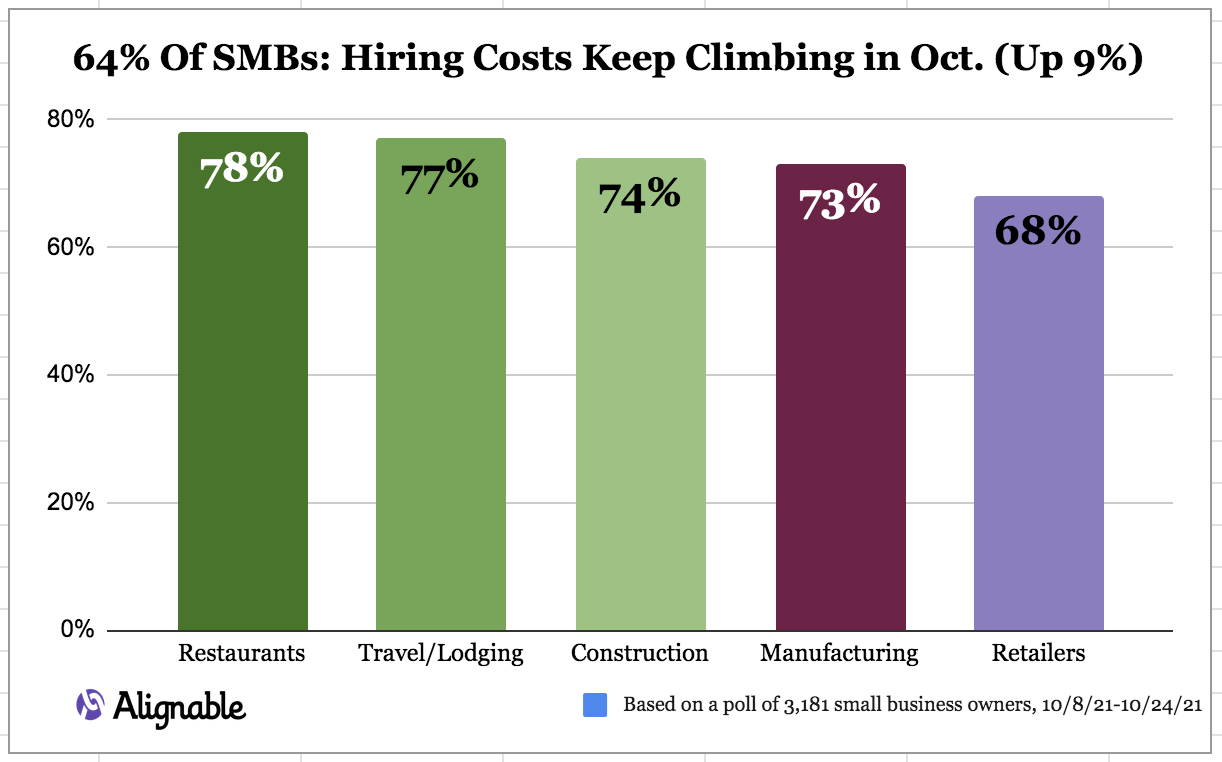

This most recent survey also showed that the percentage of small business owners paying more for the salaries of the people they actually find to hire has jumped another 9% since September: 64% of small business owners report paying more now than prior to COVID (up from 55% last month).

Here’s how this situation breaks down among the most-affected industries:

As you can see, many of the same industries that are continuing to struggle finding the right employees are also paying between 1% to more than 25% more for the employees they are able to find.

Compared to September, these numbers are even more significant, showing that all of these categories experienced hikes in the number of owners who must pay higher rates to attract and keep the hires that do surface for them.

- For restaurants, October’s 78% figure is up by 5% (as only 73% of restaurants reported higher employee costs in Sept.).

- For travel/lodging, employee costs jumped 11% from Sept.

- For construction, the lift from last month was 6%.

- For manufacturing, the 73% figure represents a whopping 17% month over month increase.

- For retailers, employee costs increased 8% in October.

And here’s how much they’re paying, on average compared to last month:

- For restaurants, 49% paid from 11% to 25% more (up 26%)

- For travel lodging, 28% paid from 11% to 25% more (same as Sept.)

- For construction, 31% paid from 11% to 25% more (up 7%)

- For retailers, 26% paid from 11% to 25% more (up 4%)

Inflation Is Now The No. 1 SMB Concern

Given these statistics, and many more in Alignable’s just-released October Road To Recovery, it’s not a surprise to see that the No. 1 concern among most small businesses in October has shifted from more Delta-related government shutdowns to increasing inflation.

In fact, now nearly half of all small businesses (48%) say inflation is their top worry, jumping 10% from September.

For more details on this poll and others, please contact me at chuck@alignable.com.

For any small businesses struggling with hiring, please consult our article, How Employees & Employers Find Each Other.