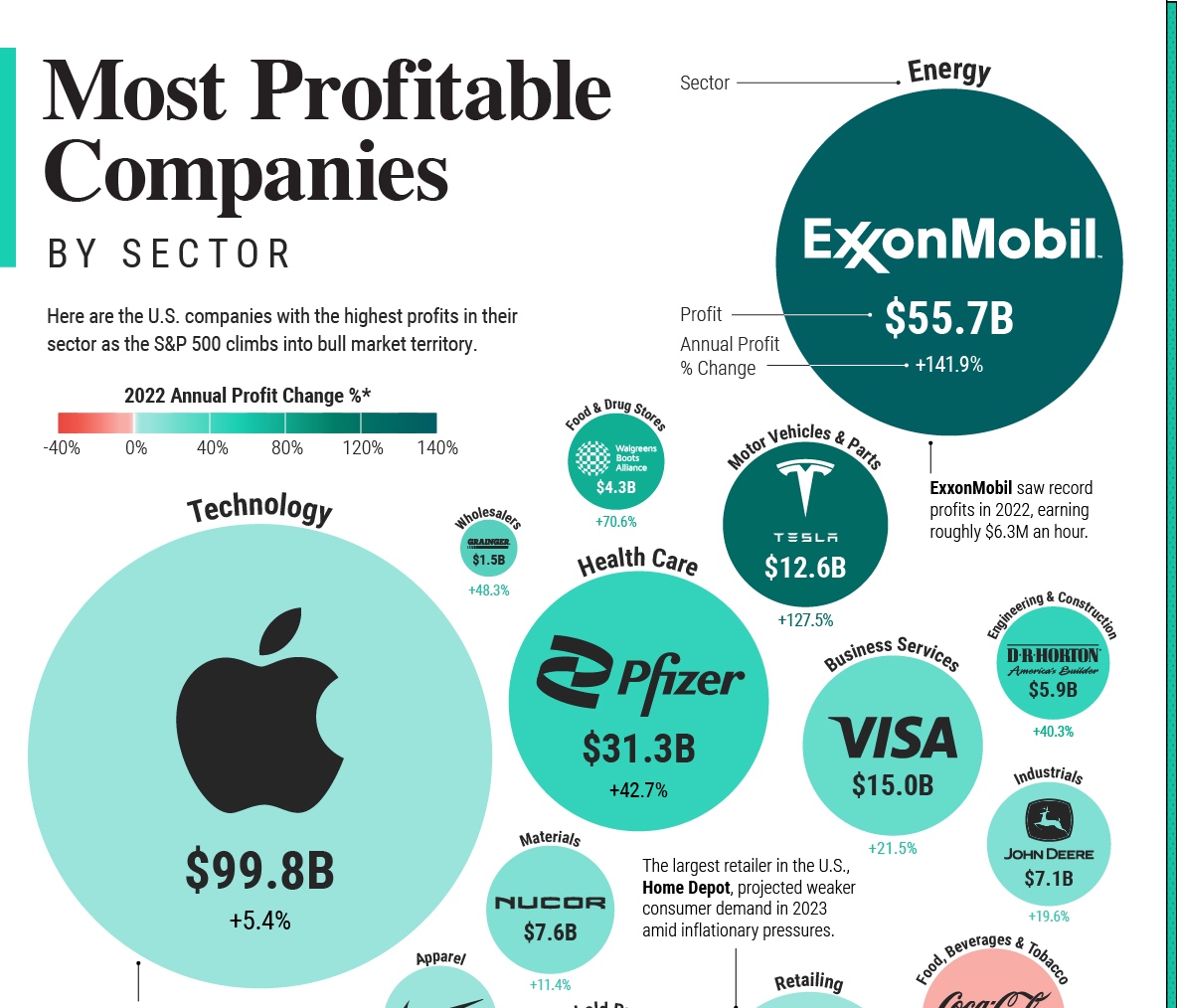

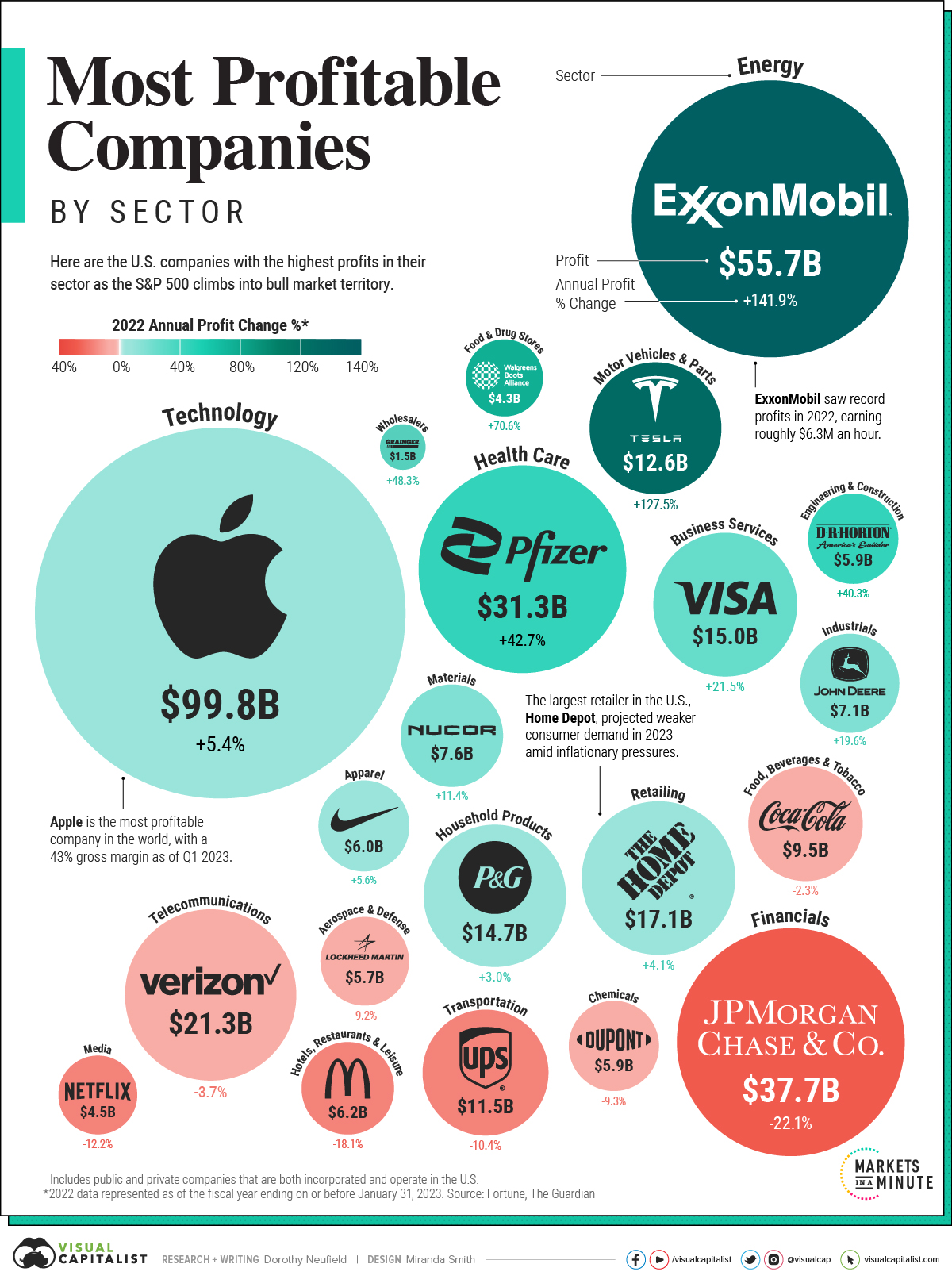

The year 2022 saw U.S. corporate profits reaching record levels despite a bear market and soaring inflation. Amidst these challenging conditions, investors have been closely monitoring corporate fundamentals, with profit margins serving as a crucial indicator of financial health and resilience. Fortune has compiled data on the most profitable companies in the United States across various sectors, shedding light on their annual profits and changes in percentage.

At the forefront of this ranking is Apple, the technology giant that amassed nearly $100 billion in profits last year. Notably, Apple’s profit exceeded the combined profits of the leading companies in the energy and financial sectors. The company’s net profit margin stood at an impressive 25% at the end of 2022. As the smartphone market matures, Apple has been shifting its focus towards service-based revenue, with services sales experiencing a 14% annual growth.

Exxon Mobil secured the top spot in the energy sector, posting record profits of over $55 billion. This remarkable increase of almost 142% can be attributed to surging oil prices following Russia’s invasion of Ukraine, as well as cost reductions implemented during the pandemic.

In the financial sector, JPMorgan Chase emerged as the most profitable company. Despite being the largest bank in the United States based on assets, the company experienced a significant decline in its investment banking division due to less lucrative financing opportunities resulting from higher interest rates. JPMorgan Chase’s profits fell by over 22% annually.

The Federal Reserve’s research suggests that low taxes and interest rates have contributed to approximately one-third of profit growth in nonfinancial companies within the S&P 500 over the past two decades. However, as interest rates continue to rise, increased costs could impact corporate bottom lines. Nevertheless, corporations have displayed resilience thus far, with U.S. corporate profits experiencing a moderate decline of just over 5% in the first quarter of 2023.

For investors, profitability is a crucial factor to consider when identifying companies capable of withstanding higher interest rates. Companies with strong profitability can reinvest in their businesses, provide dividends to shareholders, and navigate rising costs more effectively. Moreover, high profitability often indicates a strong market share, driven by economies of scale, brand loyalty, and competitive advantages. Such sustainable profitability can generate long-term value for shareholders, ultimately supporting share prices.